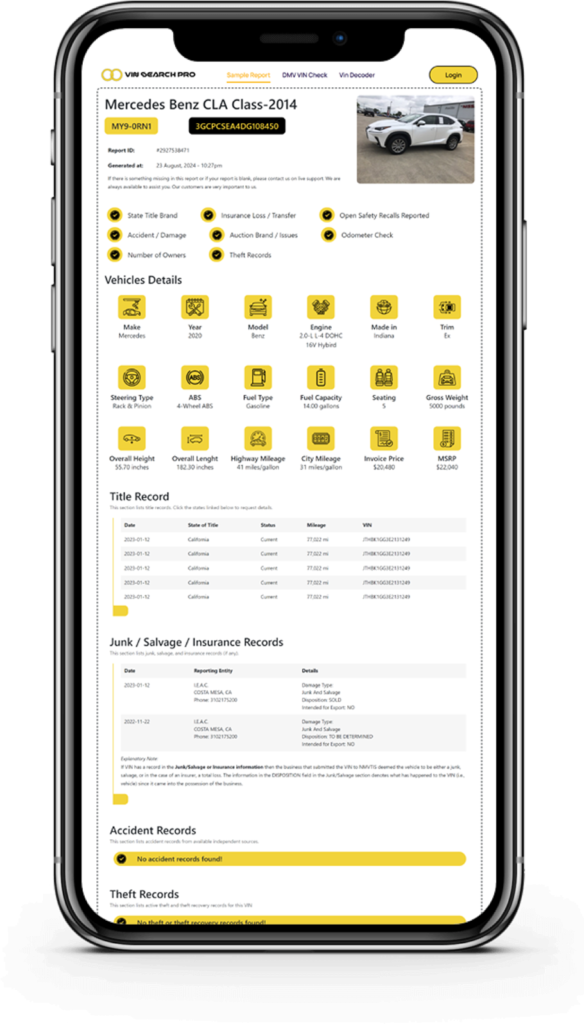

Get a complimentary VIN check to uncover a vehicle’s history, including essential details such as mileage, market value, accidents, and recall records.

AutoVIN simplifies the process of conducting a VIN search by state. Our DMV-free VIN check is perfect for potential car buyers who want to verify the history of any used vehicle they are considering purchasing in the United States. The process is straightforward and intuitive. The data obtained from our VIN checks include:

VIN Search Pro delivers accurate information sourced from reliable databases. By checking your vehicle’s history, you can understand common risks associated with a particular car, allowing you to make informed buying decisions and avoid future regrets.

Feel confident that the car you are eyeing, no matter where it’s located in the US, is in good condition with an AutoVIN report. Discover your future vehicle’s history, uncover hidden problems, and avoid unforeseen expenses.

The Vehicle Identification Number (VIN) might appear cryptic at first glance, but each of the 17 characters holds a specific piece of information about your car. With a little VIN decoding know-how, you can unlock a wealth of knowledge about your vehicle’s identity, specifications, and history. Let’s break down the VIN structure and decipher what each section tells you:

Certain states are more prone to natural disasters, accidents, and vehicle theft. Dishonest sellers might conceal issues by relocating vehicles between states.

For instance, what are your chances of purchasing a stolen car in California?

The map highlights the top 10 states with the highest flood-related disasters. Surprising to some, only two coastal states (Mississippi and Alabama) are listed, while most flooding occurs inland. Vehicles from these states are more likely to have flood damage.

Hurricanes Harvey and Irma were among the costliest in US history, greatly impacting the southern US in 2017. Such events significantly affect the history and value of used vehicles:

Below is a table listing states with the highest and lowest vehicle fatality rates in 2016. Vehicles from these states are more inclined to have been involved in such incidents.

Used vehicle buyers should consider ‘title brands’ for several reasons:

For example, one state may employ the ‘rebuilt’ brand for a salvaged vehicle that’s been restored, while another may use ‘salvage’ for the same condition.

Hurricanes Harvey and Irma were among the costliest in US history, greatly impacting the southern US in 2017. Such events significantly affect the history and value of used vehicles:

Liability for medical expenses and loss of earnings related to crashes varies by state:

Most states require vehicle owners to have insurance. Exceptions include Virginia and New Hampshire, though at-fault drivers remain liable. Some states offer alternatives like surety bonds or cash deposits.

Total Loss Thresholds Determining ‘Salvage’ Status

Thresholds vary from 50% to 100%:

State |

Type of Required Coverage |

Minimum Liability Limits |

State Insurance Requirements |

Alabama |

Bodily Injury and Property Damage Liability |

25/50/25 |

|

Alaska |

Bodily Injury and Property Damage Liability |

50/100/25 |

|

Arizona |

Bodily Injury and Property Damage Liability |

15/30/10 |

|

Arkansas |

Bodily Injury and Property Damage Liability |

25/50/15 |

|

California |

Bodily Injury and Property Damage Liability |

15/30/5 |

|

Colorado |

Bodily Injury and Property Damage Liability |

25/50/15 |

|

Connecticut |

Bodily Injury and Property Damage Liability, Uninsured/Underinsured Motorist |

25/50/25 |

|

Delaware |

Bodily Injury and Property Damage Liability, Personal Injury Protection |

25/50/10 However, it's also important to note that personal injury protection (PIP) is $15,000. |

|

District of Columbia |

Bodily Injury and Property Damage Liability, Uninsured Motorist |

25/50/10 and

|

|

Florida |

Property Damage Liability, Personal Injury Protection |

PIP: $10,000 Property damage liability (PDL): $10,000 |

|

Georgia |

Bodily Injury and Property Damage |

25/50/25 |

|

Hawaii |

Bodily Injury and Property Damage Liability, Personal Injury Protection |

PIP is $10,000. |

|

Idaho |

Bodily Injury and Property Damage Liability |

25/50/15 |

|

Illinois |

Uninsured and Underinsured Motorist Bodily Injury Coverage |

25/50/20 Uninsured/underinsured motorist is $25,000 per person and $50,000 total per accident |

|

Indiana |

Bodily Injury and Property Damage Liability, Uninsured Motorist* *It's important to note that uninsured motorist coverage is only required unless rejected by the insured in writing. |

25/50/25 Uninsured motorist is equal to the minimum limits for liability coverage |

|

Iowa |

All motorists must have bodily injury and property damage insurance. |

20/40/15 |

See Iowa Insurance Division |

Kansas |

Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist |

25/50/25

|

|

Kentucky |

Bodily Injury and Property Damage Liability, Personal Injury Protection |

25/50/25 PIP: $10,000 |

|

Louisiana |

Bodily Injury and Property Damage Liability |

15/30/25 |

|

Maine |

Bodily Injury and Property Damage Liability, Uninsured/Underinsured Motorist |

50/100/25

|

|

Maryland |

Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured/Underinsured Motorist |

30/60/15 and

|

|

Massachusetts |

Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist |

20/40/5 and

|

|

Michigan |

Bodily Injury and Property Damage Liability, Personal Injury Protection |

Property Protection Insurance (PPI) coverage is $1 million limit per accident |

See Michigan.gov |

Minnesota |

Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured/Underinsured Motorist |

30/60/10 and

|

|

Mississippi |

Bodily Injury and Property Damage |

25/50/25 |

No, see Mississippi Insurance Department |

Missouri |

Bodily Injury and Property Damage Liability, Uninsured Motorist |

25/50/25 and

|

|

Montana |

Bodily Injury and Property Damage Liability |

25/50/20 |

|

Nebraska |

Uninsured/Underinsured Motorist Bodily Injury Coverage |

Uninsured/underinsured Motorist coverage is 25/50 |

|

Nevada |

Bodily Injury and Property Damage Liability |

25/50/20 |

|

New Hampshire |

Drivers are not required to purchase car insurance. If you do have car insurance, there are mandatory minimums. The state also requires you to show proof of financial responsibility if you don't have car insurance. You remain liable for someone's injuries and damages that you cause to another person's vehicle or property. |

25/50/25 |

|

New Jersey |

Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist Bodily Injury Coverage, Underinsured Motorist Bodily Injury Coverage, Uninsured Motorist Property Damage Coverage, and Underinsured Motorist Property Damage Coverage |

Uninsured motorist and underinsured motorist coverage is 15/30 for bodily injuries Uninsured motorist and underinsured motorist property damage coverage is 5, with a $500 deductible |

|

New Mexico |

Bodily Injury and Property Damage Liability |

25/50/10 |

See New Mexico Motor Vehicle Division |

New York |

Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist |

PIP is 50 Uninsured motorist coverage is 25 per person and 50 per accident |

|

North Carolina |

Bodily Injury, Property Damage Liability, Uninsured and Underinsured Motorist Coverage |

Uninsured motorist and underinsured motorist coverage is 30/60 with a minimum of 30/60/25 |

|

North Dakota |

Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist |

PIP is 30 per person at a minimum |

|

Ohio |

Bodily Injury and Property Damage Liability |

25/50/25 |

|

Oklahoma |

Bodily Injury and Property Damage Liability |

25/50/25 |

|

Oregon |

Bodily Injury and Property Damage Liability |

25/50/20 and

|

|

Pennsylvania |

Bodily Injury and Property Damage Liability |

15/30/5 and

|

See PennDOT |

Rhode Island |

Bodily Injury and Property Damage Liability, Uninsured Motorist |

25/50/25 and

|

|

South Carolina |

Bodily Injury and Property Damage Liability, Uninsured Motorist |

25/50/25 and

|

|

South Dakota |

Bodily Injury and Property Damage Liability, Uninsured Motorist |

25/50/25 and

|

|

Tennessee |

Bodily Injury and Property Damage Liability |

25/50/15 |

|

Texas |

Bodily Injury and Property Damage Liability |

30/60/25 |

|

Utah |

Bodily Injury and Property Damage Liability, Personal Injury Protection |

25/65/15 and

|

|

Vermont |

Bodily Injury and Property Damage Liability, Uninsured/Underinsured Motorist |

25/50/10 and

|

|

Virginia |

Bodily Injury and Property Damage Liability, Uninsured Motorist |

30/60/20 and

|

See Virginia DMV |

Washington |

Bodily Injury and Property Damage Liability |

25/50/10 |

|

West Virginia |

Bodily Injury and Property Damage Liability, Uninsured Motorist |

25/50/25 and

|

|

Wisconsin |

Bodily Injury and Property Damage Liability, Uninsured Motorist Bodily Injury Coverage, Underinsured Motorist Bodily Injury Coverage |

25/50/10 and

|

See Wisconsin DMV |

Wyoming |

Bodily Injury and Property Damage Liability |

25/50/25 |

Refer to the table below for specific state thresholds.

AutoVIN vehicle history reports are excellent tools for understanding a used car’s complete story. Access our service anytime, anywhere. Visit our website for essential resources to better evaluate your options.

AutoVIN vehicle history reports are excellent tools for understanding a used car’s complete story. Access our service anytime, anywhere. Visit our website for essential resources to better evaluate your options.